Nota Penerangan Jadual PCB 2010. Borang PCB TP1 2010.

Malaysian Tax Issues For Expats Activpayroll

Introduced SOCSO calculation and removal of RM2000 special tax relief.

. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Malaysia Income Tax Calculator. Borang PCB TP2 2010.

With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. Income Tax Rates and Thresholds Annual Tax Rate. If you need to check total tax payable for assessment year 2022 just enter your 2021 yearly income into the Bonus field leave Salary field empty and enter whatever allowable deductions for 2021 to calculate the total amount of tax for 2021.

Borang PCB TP3 2010. After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. Dont forget to change PCB year to 2021.

Monthly Tax Deduction 2020 for Malaysia Tax Residents optionname00 Allowance Bonus0000. On the First 5000. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN. Updated PCB calculator for YA2021 and 9 EPF calculation. Here are the progressive income tax rates for Year of Assessment 2021.

Click for the 2019 State Income Tax Forms. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Malaysia Monthly Salary After Tax Calculator 2022.

Calculation of yearly income tax for assessment year 2022. Enter Your Salary and the Malaysia Salary Calculator will automatically produce a salary after tax illustration for you simple. EPF tax relief limit revised to RM4000 per year.

A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019. Assessment Year 2018-2019 Chargeable Income. Malaysia Corporate Income Tax Calculator for YA 2020 and After.

Enter the pay yuan Net Tax Payable yuan RESET. Income Tax Calculator Malaysia Calculate Personal Income Tax. Follow these simple steps to calculate your salary after tax in Malaysia using the Malaysia Salary Calculator 2022 which is updated with the 202223 tax tables.

10 Dec 2021. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Calculations RM Rate TaxRM A.

Malaysia Non-Residents Income Tax Tables in 2019. Select Advanced and enter your age to alter. Income tax for Malaysia is calculated by All individuals are liable to pay tax on income accrued in derived from or remitted to Malaysia.

Income Tax Rates and Thresholds Annual Tax Rate. Malaysia Annual Salary After Tax Calculator 2019. Calculations RM Rate TaxRM 0 - 5000.

The calculator is designed to be used online with mobile desktop and tablet devices. On the First 5000 Next 15000. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

Theres still time for you to carefully. Included 7 EPF calculation. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income. Employee EPF contribution has been adjusted to follow EPF Third Schedule. So make sure to file your.

Updated PCB calculator for YA2020. Explanatory Notes MTD 2013. The calculator is designed to be used online with mobile desktop and tablet devices.

Introduced Tax Resident toggle for local and foreigner tax residents to omit EPF contributions. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Kalkulator PCB Lembaga Hasil Dalam Negeri. Inland Revenue Boards Kalkulator PCB.

Updated PCB calculator for YA2019. Inland Revenue Board of Malaysia shall not be liable for any loss or. PCB TP1 FORM 2010.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. For example lets say your annual taxable income is RM48000.

The system is thus based on the taxpayers ability to pay. Malaysia Non-Residents Income Tax Tables in 2019. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes.

Employee EPF contribution has been adjusted to follow EPF Third Schedule. On the First 5000. The current CIT rates are provided in the following table.

With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts. Updated PCB calculator for YA2020. Update of PCB calculator for YA2017.

Employer Employee Sub-Total. PCB TP3 FORM 2010. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Introduced bonus feature as an additional income source to calculate PCB. Explanatory Notes MTD 2012. China income Tax Calculator.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. Nota Penerangan Jadual PCB 2012. Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment.

On 11 October 2019 YB Lim Guan Eng the Minister of Finance unveiled the Malaysian Budget 2020. Explanatory Notes MTD 2010. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Spouse and children relieves introduced. PCB TP2 FORM 2010.

With our income tax calculator you can roughly estimate how much tax savings you will be able to make when you file for your tax in 2019. Include your 2019 Income Forms with your 2019 Return. Nota Penerangan Jadual PCB 2013.

Monthly Tax Deduction Pcb Calculator Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

How To Calculate Income Tax In Excel

Irbm S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

Income Tax Malaysia 2018 Mypf My

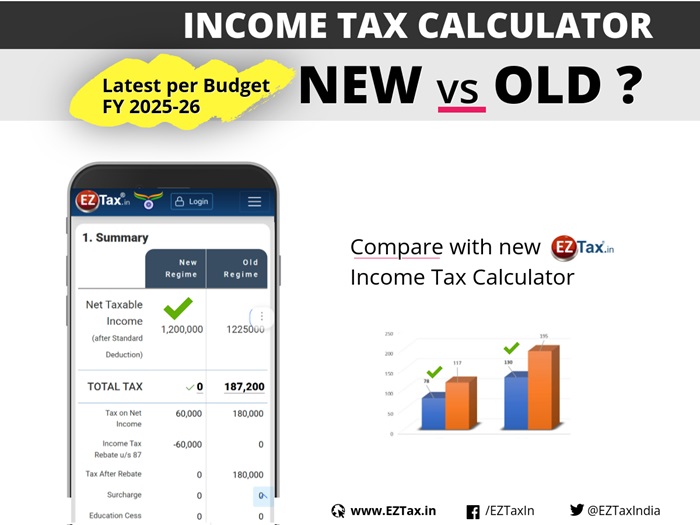

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

How To Do Pcb Calculator Through Payroll System Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

![]()

Tax Government Calculation Vector Color Line Icon Report And Financial Statements Bookkeeping And Accounting Stock Vector Image Art Alamy

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

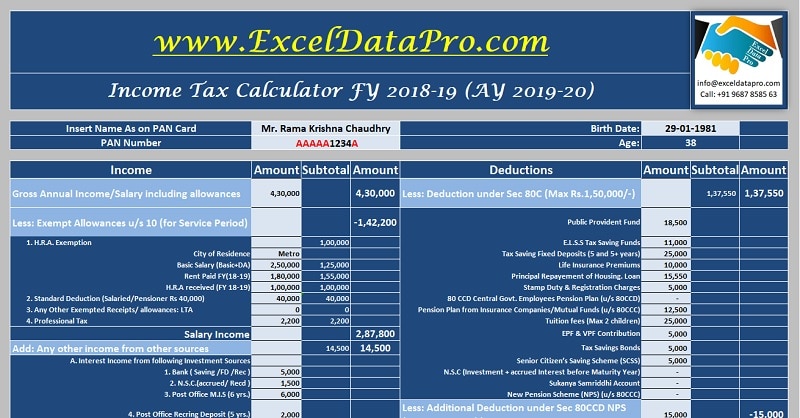

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Income Tax Malaysia 2018 Mypf My

Individual Income Tax In Malaysia For Expatriates

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Malaysia Personal Income Tax Guide 2017 Ringgitplus Com

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator